Introduction

Starting a business is an exciting journey that often requires financial backing to turn your dreams into reality. Whether you’re launching a brand-new venture or need a boost for your existing small business, securing the right funding is crucial. In this comprehensive guide, we’ll explore the world of business loans, the types of business loans available, interest rates, repayment options, and more.

Business Loans: A Helping Hand for Entrepreneurs

Business loans serve as a lifeline for entrepreneurs and small business owners. They provide the capital necessary to cover initial expenses, expand operations, or weather unexpected financial challenges. If you’re considering a business loan, it’s essential to understand your options and how they can benefit your venture.

When it comes to business loans, there’s no one-size-fits-all solution. Different types of loans cater to various needs, and it’s crucial to choose the one that aligns with your business goals. Here are some common types of business loans:

- Start-up Business Loans: These loans are tailored for entrepreneurs just beginning their business journey. They provide initial capital to cover expenses like equipment, inventory, and marketing.

- Small Business Loans: Small business loans are designed for existing businesses looking to expand, purchase assets, or address cash flow issues. They offer more flexibility in terms and repayment options.

- Business Loan Calculator: Before diving into the loan application process, it’s wise to estimate your potential loan amount and monthly payments using a business loan calculator. This tool helps you set realistic expectations and create a budget for loan repayment.

- Fixed Interest Rates: Many business loans come with fixed interest rates, providing stability and predictability for your budget. Knowing your interest rate upfront allows you to plan for consistent monthly payments.

- Flexible Terms Available: Business loans offer various term lengths, allowing you to choose a repayment schedule that aligns with your business’s cash flow. Short-term loans are ideal for quick financing, while long-term loans spread out payments over several years.

- Repayment Holiday: Some lenders offer repayment holidays, allowing you to defer payments for a specific period. This can be especially helpful during slow seasons when your business needs extra breathing room.

- Representative Example: Understanding the costs associated with your loan is essential. Lenders provide a representative example that outlines the total loan cost, including interest and fees. This example gives you a clear picture of the financial commitment you’re entering into.

Assessing Your Eligibility

Now that you have an idea of the types of business loans and their features, you might be wondering, “Am I eligible?” It’s essential to check your eligibility before applying for a loan to avoid unnecessary rejections that could impact your credit score.

If you’re unsure about your eligibility, some lenders offer tools that allow you to check if you qualify before applying. These tools perform a soft credit check that won’t affect your credit score, giving you peace of mind.

Let’s Take a Look at The Pros and Cons of Finance Types

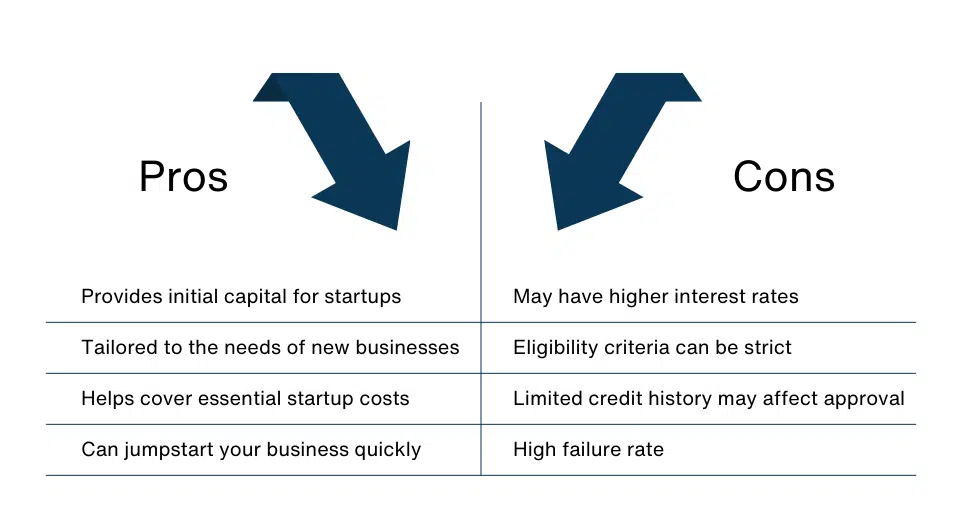

Startup Business Loans:

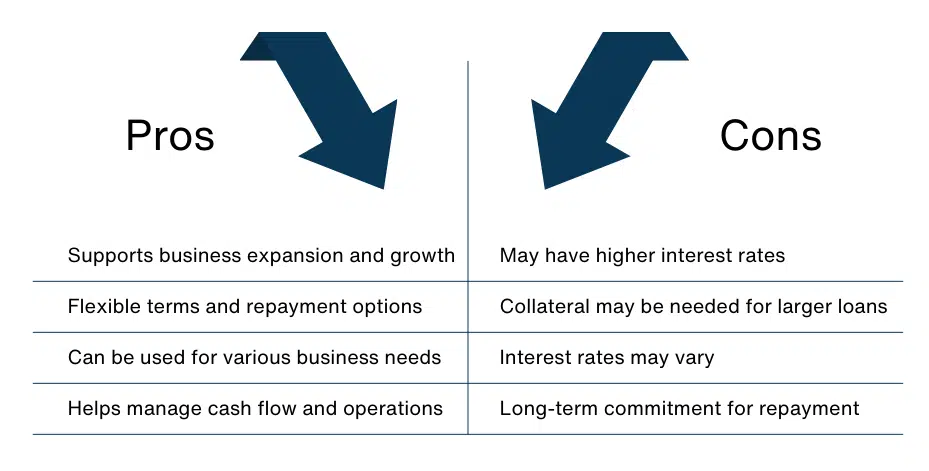

Small Business Loans:

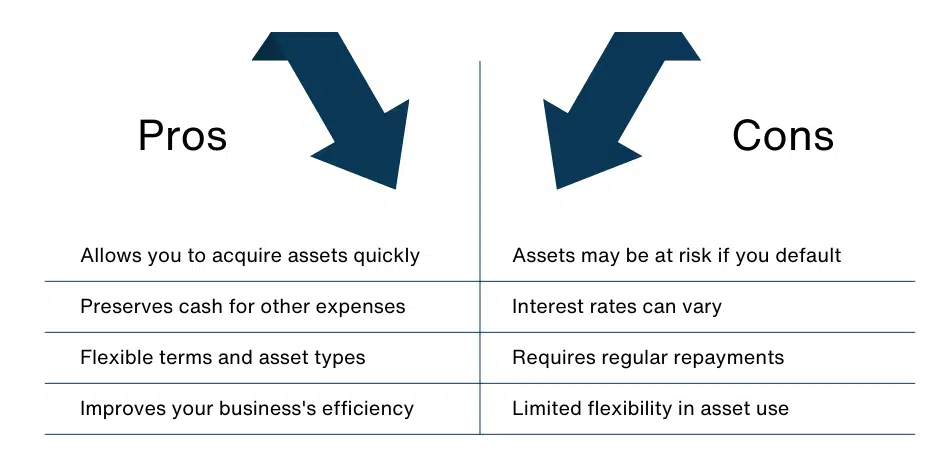

Asset Finance:

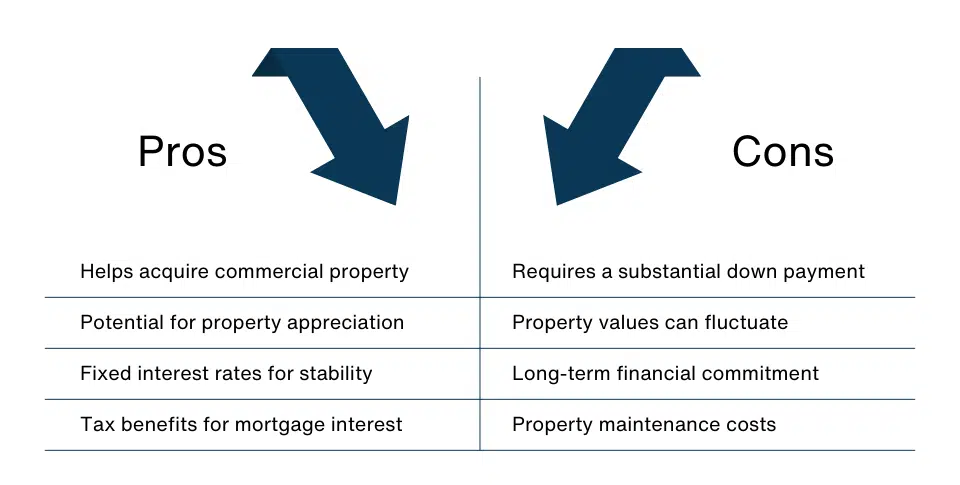

Business Mortgages

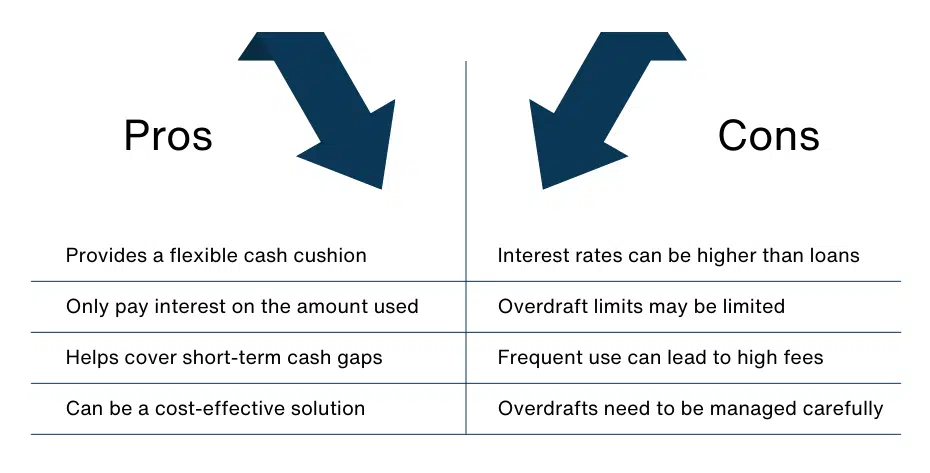

Overdrafts for Everyday Cash Flow

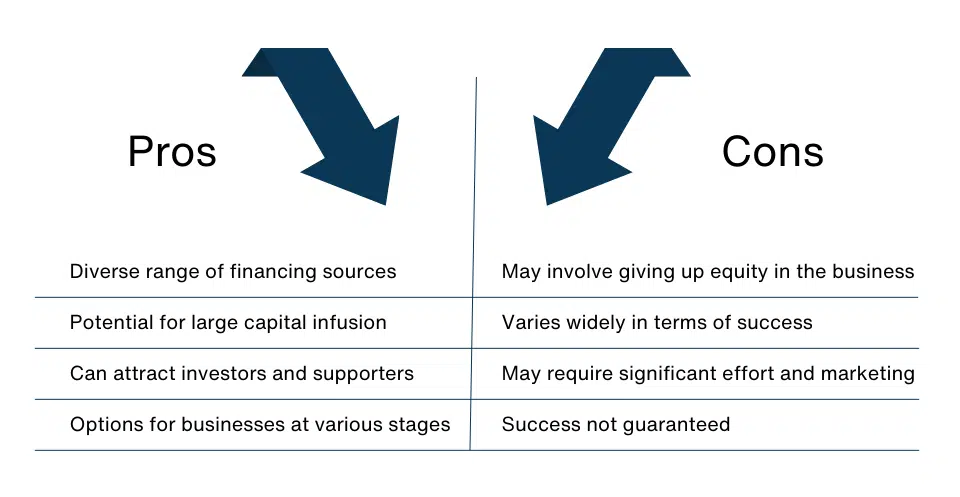

Other Funding Options (e.g., Equity Investment, Crowdfunding)

Ready to Apply or Want to Find Out More?

Once you’ve assessed your eligibility and estimated your loan amount, you can decide if you’re ready to apply. Many lenders offer online application processes that make it convenient and straightforward to submit your loan request. Keep in mind that each lender may have slightly different requirements, so it’s essential to review their specific application criteria.

If you’d like more information or have questions about business loans, most lenders provide customer support to assist you in making an informed decision.

Frequently Asked Questions

Here are some common questions aspiring entrepreneurs and small business owners often have about business loans:

- What’s the Difference Between a Startup Loan and a Small Business Loan?

Startup loans are designed for brand-new businesses that need initial funding to get off the ground. Small business loans, on the other hand, cater to existing businesses looking to grow, expand, or address financial challenges.

- How Do Interest Rates Affect My Loan?

Interest rates determine the cost of borrowing. Lower interest rates mean lower overall loan costs, so it’s crucial to compare rates and choose the most favourable option for your business.

- Can I Get a Business Loan with Bad Credit?

While a strong credit score can improve your loan eligibility and terms, some lenders offer options for borrowers with less-than-perfect credit. However, these loans may come with higher interest rates or stricter repayment terms.

- What Documents Do I Need to Apply for a Business Loan?

Lenders typically require documents such as business financial statements, tax returns, a business plan, and personal financial information when you apply for a business loan. Be prepared to provide these documents during the application process.

Conclusion:

Securing the right financing for your startup or small business is a critical step in achieving your goals. Whether you’re launching a new venture or seeking growth opportunities, understanding the types of business loans available, interest rates, and repayment options is essential.

By making informed decisions and exploring various funding sources, you can pave the way for your business’s success.

If you are seeking further information about business loans, Fundur is here to support you in making informed decisions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success. With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.