Introduction

In recent years, the United Kingdom has witnessed a remarkable surge in businesses receiving funding across various sectors. This influx of financial support has played a pivotal role in fueling entrepreneurship, innovation, and economic growth. In this blog post, we will explore the factors contributing to this rise, the impact it has had on businesses, and the implications for the UK economy as a whole.

Government Initiatives and Support:

The UK government has been actively promoting and supporting entrepreneurship through a range of initiatives. Notably, the introduction of schemes like the British Business Bank and the Enterprise Investment Scheme (EIS) has provided tax incentives and easier access to funding for start-ups and small businesses. These initiatives have helped to foster a favourable ecosystem for entrepreneurs and attract investments from both domestic and international sources.

Increased Venture Capital Investments:

The UK has seen a surge in venture capital investments, with both domestic and international investors recognizing the potential for high growth and returns in the country’s start-up ecosystem. According to a report by PitchBook, venture capital investment in UK start-ups reached a record high in recent years, with London being a key hub attracting significant funding. This increased funding has provided start-ups and innovative businesses with the necessary capital to develop their products, expand their operations, and bring disruptive ideas to market.

Rise of Alternative Funding Channels:

In addition to traditional venture capital, alternative funding channels such as crowdfunding and peer-to-peer lending platforms have gained traction in the UK. These platforms have democratized the funding landscape, allowing businesses to access capital directly from a large pool of individual investors. The emergence of these alternative funding options has created new avenues for entrepreneurs, particularly those who may have struggled to secure funding through traditional channels.

Increased Focus on Tech and Innovation:

The UK has been a hotbed for technology and innovation, attracting businesses in sectors such as fintech, artificial intelligence, biotech, and clean energy. The growth of these industries has captured the attention of investors, leading to a surge in funding for companies at the forefront of technological advancements. The development of technology clusters, such as London’s Silicon Roundabout and Manchester’s Tech City, has further facilitated collaboration, knowledge sharing, and investment opportunities.

Impact on Business Growth and Employment:

The rise in funding for businesses in the UK has had a significant impact on their growth prospects and employment opportunities. With increased access to capital, businesses can invest in research and development, expand their operations, hire talent, and bring innovative products and services to market. This growth not only benefits individual businesses but also has positive implications for job creation and economic prosperity at both regional and national levels.

Conclusion:

The rise in businesses receiving funding in the UK has been instrumental in fostering a thriving entrepreneurial ecosystem, driving innovation, and boosting economic growth. Government support, increased venture capital investments, the emergence of alternative funding channels, and the focus on technology and innovation have all contributed to this positive trend. As businesses continue to receive funding, it is expected that the UK will remain a hub of entrepreneurial activity, attracting talent and investments from around the world.

Loan Approval Rate:

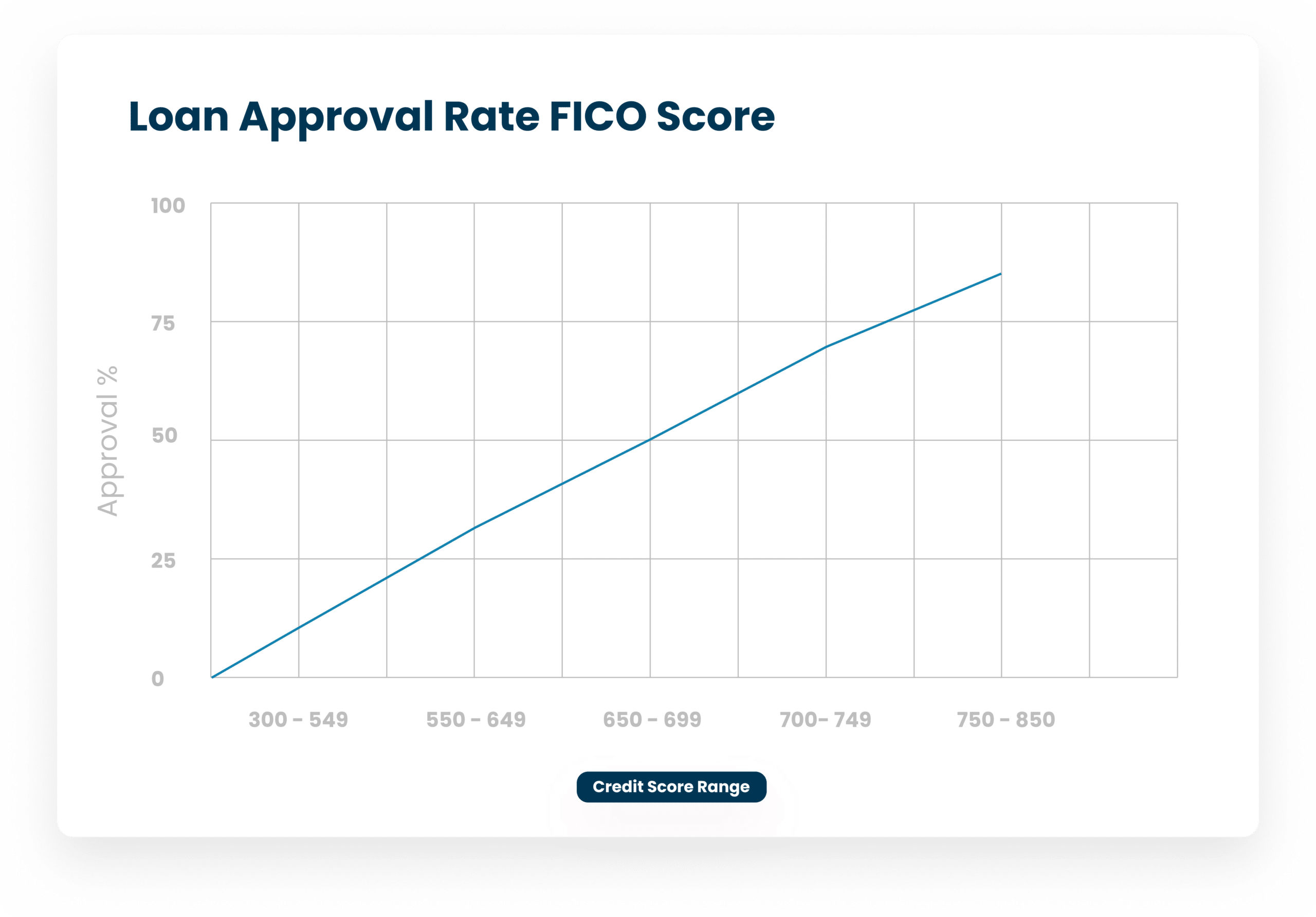

The breakdown of loan approval rates based on credit score ranges demonstrates the significant impact credit scoring models have on loan accessibility. Businesses with higher credit scores have higher approval rates, while those with lower credit scores face greater difficulties in obtaining loans. This analysis highlights the need to explore alternative credit assessment methods to ensure fair and inclusive lending practices, providing equal opportunities for businesses with diverse credit profiles.

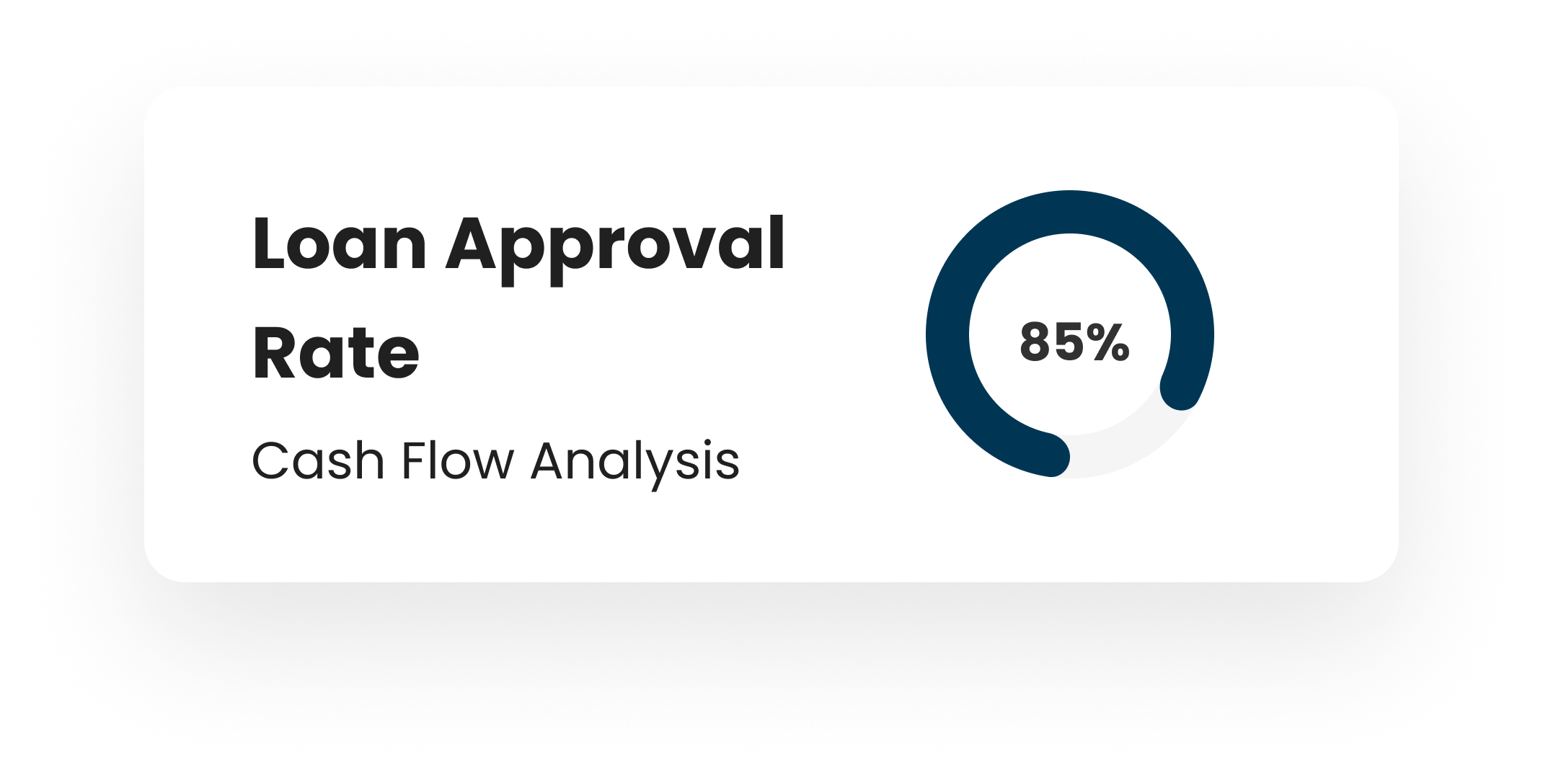

The comparison of loan approval rates between traditional credit scoring models and alternative credit assessment methods demonstrates the potential effectiveness and inclusivity of alternative methods. Cash flow analysis and industry-specific scoring models exhibit higher loan approval rates, indicating their ability to evaluate creditworthiness for businesses with limited credit history or unique business models. By incorporating these alternative methods, lenders can obtain a more comprehensive understanding of a business’s financial health and make more informed decisions, ultimately promoting fair and inclusive lending practices.

Increasing Trend of Small Businesses Turning to Alternative Lending Options:

Faster Approval Processes:

One of the significant reasons behind the increasing trend of small businesses turning to alternative lending options is the faster approval process compared to traditional financing avenues. Alternative lenders, such as merchant cash advance providers and online lending platforms, often have streamlined application processes and efficient underwriting systems, allowing businesses to receive funding more quickly. This speed is crucial for small businesses that require immediate capital to seize growth opportunities or address urgent financial needs.

Accessibility for Businesses with Limited Credit History:

Alternative lending options often consider factors beyond traditional credit scores when evaluating loan applications. This inclusivity allows businesses with limited credit history or lower credit scores to access financing options that may not have been available to them through traditional lenders. Alternative lenders may focus more on factors such as revenue history, cash flow, or industry-specific performance, enabling businesses to demonstrate their creditworthiness based on different metrics.

Online Platforms and Technology:

The rise of online lending platforms has significantly contributed to the growing popularity of alternative lending options. These platforms leverage technology to streamline the loan application and approval process, making it more convenient for small businesses to access funding. Online platforms offer user-friendly interfaces, automated underwriting, and quick disbursement of funds, empowering businesses to secure financing with ease and convenience.

Diverse Funding Needs:

Small businesses have diverse funding needs that may not fit within the strict criteria of traditional lenders. Alternative lending options, such as merchant cash advances or online lending, often cater to a wide range of purposes, including working capital, equipment purchase, marketing campaigns, or short-term cash flow needs. This flexibility in use aligns well with the specific needs and goals of small businesses.

Conclusion:

The increasing trend of small businesses turning to alternative lending options, such as merchant cash advances and online lending platforms, can be attributed to several factors. Faster approval processes, flexible repayment terms, and accessibility for businesses with limited credit history are key drivers of this shift. The rise of online platforms and technology has played a significant role in making alternative lending options more accessible and convenient for small businesses. As small businesses continue to seek financing solutions that align with their specific needs and circumstances, alternative lending options are likely to play an increasingly vital role in supporting their growth and resilience.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success. With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.