Introduction

In the dynamic landscape of modern commerce, businesses are increasingly drawn to sustainable practices that not only benefit the environment but also bolster their bottom line. Among these, the adoption of solar panels stands out as a formidable choice, offering both ecological advantages and substantial cost-saving potentials. Central to this adoption is the realm of solar panel financing, which provides businesses with accessible pathways to embrace renewable energy solutions without bearing the full upfront costs.

Understanding Solar Panel Financing in Commercial Settings

Solar panel financing encompasses a range of tailored mechanisms crafted to facilitate the acquisition of solar installations for commercial entities. These financing options cater specifically to the unique needs and scale of businesses, offering avenues such as loans, leases, power purchase agreements (PPAs), and dedicated solar financing structures.

Benefits of Solar Financing for Businesses:

- Cost Efficiency: Solar financing presents a remarkable opportunity for businesses to significantly reduce their operational costs by harnessing solar energy, resulting in substantial savings on electricity bills.

- Enhanced Sustainability: Embracing solar power demonstrates a commitment to sustainable practices, fostering a positive brand image and meeting the increasing demands of eco-conscious consumers.

- Long-Term Financial Stability: By hedging against fluctuating energy prices, businesses can secure long-term financial stability and predictability in operational expenses.

- Potential for Added Value: Commercial properties equipped with solar installations often command higher valuations, potentially translating into increased asset value.

Financial Comparison for Commercial Enterprises:

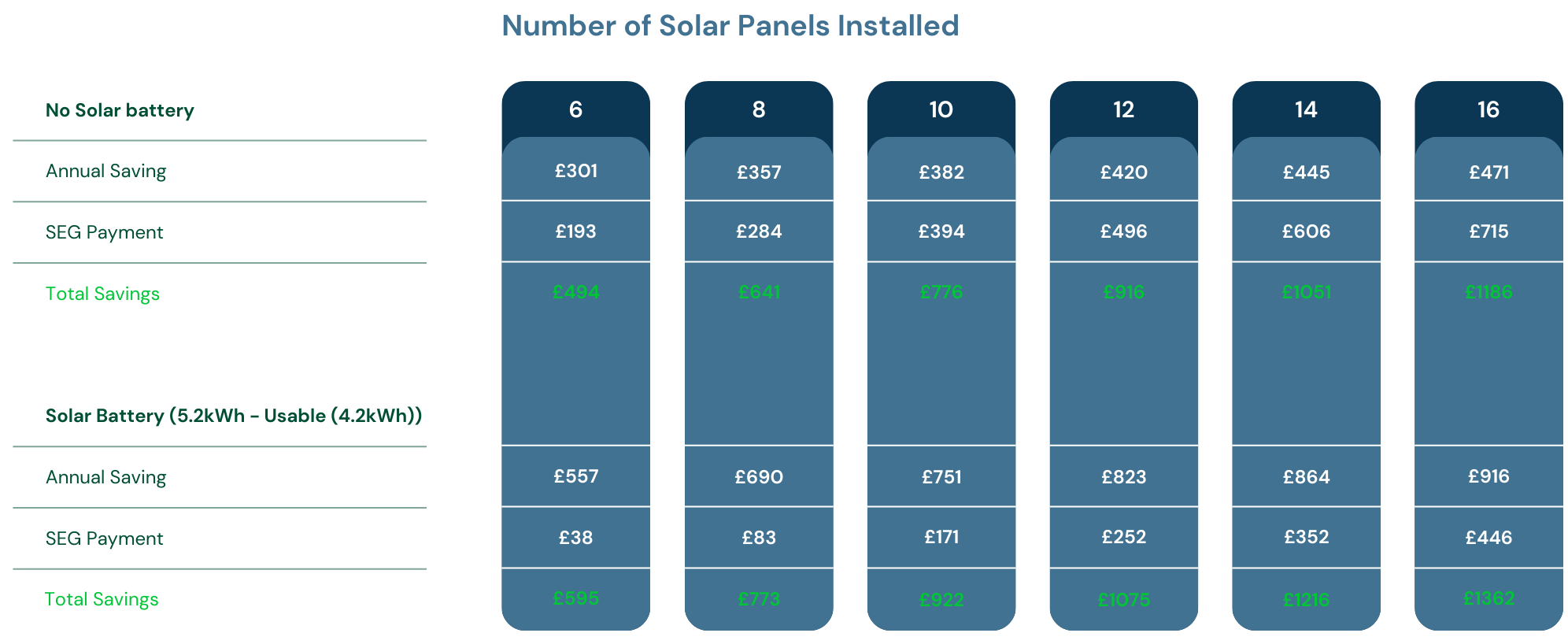

Here’s a comparative overview outlining the potential savings with solar panels.

Understanding Solar Battery Financing:

Solar battery financing enables businesses to acquire energy storage systems that work in tandem with solar panels. These batteries store excess energy generated by solar panels during peak production times and release it when energy demands are high or during non-sunny periods.

Benefits of Solar Batteries and Financing:

- Energy Independence: Solar batteries empower businesses to store excess energy, reducing reliance on the grid during peak hours and ensuring a consistent power supply even in adverse weather conditions or grid outages.

- Optimised Energy Usage: With batteries, businesses can manage their energy consumption more efficiently, using stored energy during high-demand periods to reduce reliance on expensive grid electricity.

- Increased Savings: When coupled with solar panels, batteries contribute to greater cost savings by maximising the self-consumption of generated solar power and reducing dependence on traditional energy sources.

Financial Considerations and Savings:

While the upfront cost of batteries can be substantial, financing options mitigate this by allowing businesses to spread the cost over time. The savings generated from reduced reliance on the grid and optimised energy usage contribute significantly to the overall financial benefit.

Conclusion:

Solar panel financing emerges as a powerful tool for commercial entities looking to embrace sustainability while enhancing financial viability. This move towards renewable energy solutions not only contributes to a greener future but also positions businesses as responsible, forward-thinking entities in their respective industries.

Selecting the right solar financing option demands careful consideration, aligning with the unique needs, financial goals, and future projections of commercial enterprises. Consulting with experts and understanding the intricacies of each financing avenue remains pivotal in making informed and beneficial choices.

As the global shift towards renewable energy intensifies, solar financing empowers commercial ventures to not just save costs but also pave the way for a more sustainable and prosperous future. Leveraging solar energy in commercial operations marks a strategic move towards resilience, cost-efficiency, and responsible business practices in the evolving market landscape.

Ready to power up your business with solar energy? Get in touch with Fundur and talk to one of our specialists today.

If you are seeking further information about business loans, Fundur is here to support you in making informed decisions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success. With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.