Introduction

Running a successful restaurant demands not just culinary expertise but also reliable and efficient equipment. From commercial ovens to refrigeration units and specialised catering gear, the cost of acquiring quality restaurant equipment can be significant. However, navigating these expenses is made more accessible through restaurant equipment financing options available in the UK.

How Does Financing Equipment Work?

Equipment financing is a funding solution designed specifically for businesses to acquire necessary equipment without the immediate need for substantial capital outlay. In the UK, this involves partnering with financial institutions or lenders to secure funding for restaurant equipment, typically through the following methods:

- Leasing: This option allows businesses to use equipment for a set period while making regular payments. At the end of the lease term, there might be options to purchase the equipment, renew the lease, or upgrade to newer models.

- Hire Purchase: Under this arrangement, the business hires the equipment and pays in instalments over an agreed-upon period. Ownership is transferred once the final payment is made.

- Asset Finance: This broader term encompasses both leasing and hire purchase, offering businesses the flexibility to obtain equipment while spreading costs over time.

Catering Equipment That We Can Finance

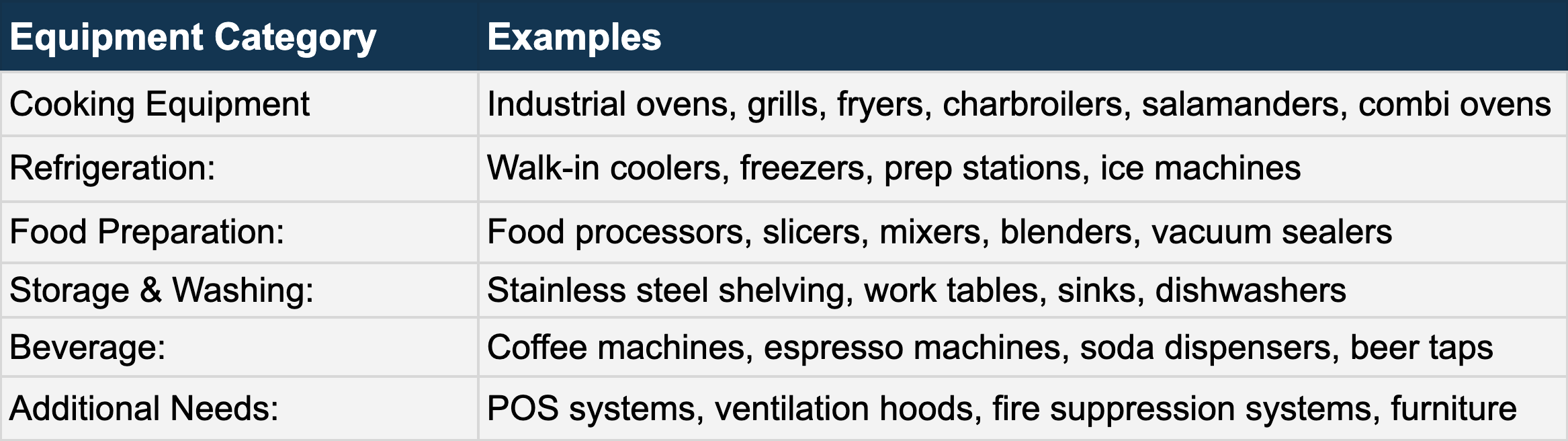

In the UK, various types of catering equipment can be financed to support the operational needs of restaurants. Here’s a comprehensive table outlining some essential catering equipment often financed by establishments:

Remember: This is just a sampling, and the specific equipment you need will depend on your unique menu and operation.

Advantages of Equipment Financing in the UK

- Preserve Cash Flow: Financing equipment allows businesses to preserve cash reserves for other operational expenses or unforeseen circumstances.

- Date Equipment: Regular payments enable access to modern, state-of-the-art equipment, fostering efficiency and competitiveness.

- Tax Benefits: Depending on the financing method, businesses may benefit from tax advantages, such as deducting lease payments from taxable income.

- Flexible Payment Options: Financing plans offer flexible payment schedules tailored to the business’s cash flow, easing financial strain.

- Asset Protection: Leasing or hire purchase agreements often come with maintenance and service agreements, safeguarding against unexpected equipment malfunctions.

Key Aspects to Consider:

- Loan Term: Choose a term that balances monthly affordability with repayment speed.

- Deposit: Some leases require a deposit, impacting your initial outlay.

- Early Settlement Costs: Understand any penalties for paying off the lease early.

Conclusion:

In the UK, restaurant equipment financing provides an avenue for establishments to acquire essential equipment while managing cash flow effectively. By understanding the various financing options and the range of catering equipment available for financing, restaurants can make informed decisions to propel their operations towards success.

Consultation with finance experts can further enhance decision-making processes, ensuring that the chosen financing option optimally supports your business goals.

Get in touch with Fundur and talk to one of our specialists today.

If you are seeking further information about business loans, Fundur is here to support you in making informed decisions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success. With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.