Introduction

In the world of business, a reliable van can be the backbone of success, enabling seamless operations and efficient logistics. Whether you’re a sole proprietor or a limited company, obtaining the right van through suitable finance options is pivotal. Understanding the nuances of van finance for business needs can make a substantial difference in your operational efficiency and financial health.

Van Finance Essentials

Van finance refers to the diverse range of financial solutions available to individuals and businesses looking to acquire vans. These options include loans, leases, hire purchase agreements, and more. Each option has distinct features that cater to different business requirements.

Finance a Van: Exploring Options

- Hire Purchase (HP): This financing option allows businesses to acquire a van while spreading the cost over a fixed period. With HP, ownership transfers to the business once the final payment, including interest, is made.

- Leasing: Leasing involves paying a monthly fee to use the van, without owning it outright. This option often includes maintenance and servicing, making it convenient for businesses.

- Loans: Business loans are another route for van financing, offering flexibility in terms of repayment structures and interest rates.

Van Finance for Limited Companies

Limited companies have specific options tailored to their structure. Limited Company Van Finance (Ltd Company Van Finance) is designed to cater to the financial needs of such entities. This financing can be advantageous due to potential tax benefits and distinct terms tailored to corporate entities.

Exploring Van Finance for Business

Key Considerations

- Credit Rating: A good credit score can significantly impact the terms and rates offered for van finance. Maintaining a healthy credit profile is crucial.

- Deposit: Some finance options require a deposit. Consider the available budget for upfront payments when choosing the financing route.

- Mileage and Usage: Leases often come with mileage restrictions. Assess your business needs to ensure the chosen finance option aligns with your usage requirements.

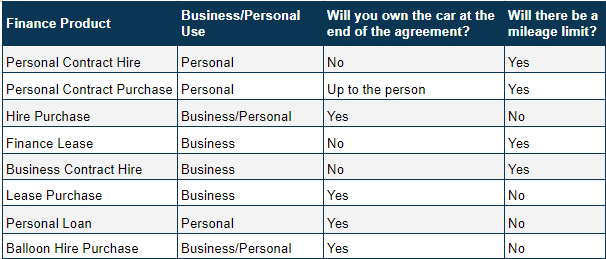

Comparing Finance Options

Used Vans on Finance

Apart from financing options, considering used vans can be a cost-effective choice for businesses. Used Vans on Finance present an opportunity to acquire reliable vehicles at reduced costs. Conducting thorough inspections and understanding the vehicle’s history is crucial when opting for used vans.

Conclusion:

Navigating the realm of van finance for business necessitates a deep understanding of available options, company structure, and financial capabilities. Whether it’s considering Ltd Company Van Finance or exploring used vans on finance, aligning the choice with your business’s specific needs is crucial.

Consultation with finance experts can further enhance decision-making processes, ensuring that the chosen financing option optimally supports your business goals.

Get in touch with Fundur and talk to one of our specialists today.

If you are seeking further information about business loans, Fundur is here to support you in making informed decisions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success. With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.