Introduction

The pub culture in the United Kingdom is not just about pints and conversations; it’s a cornerstone of community life. If you’re considering opening or expanding a pub, one critical aspect is understanding how to finance it. This blog will delve into the intricacies of pub finance in the UK, shedding light on the process and key considerations.

Understanding Pub Financing:

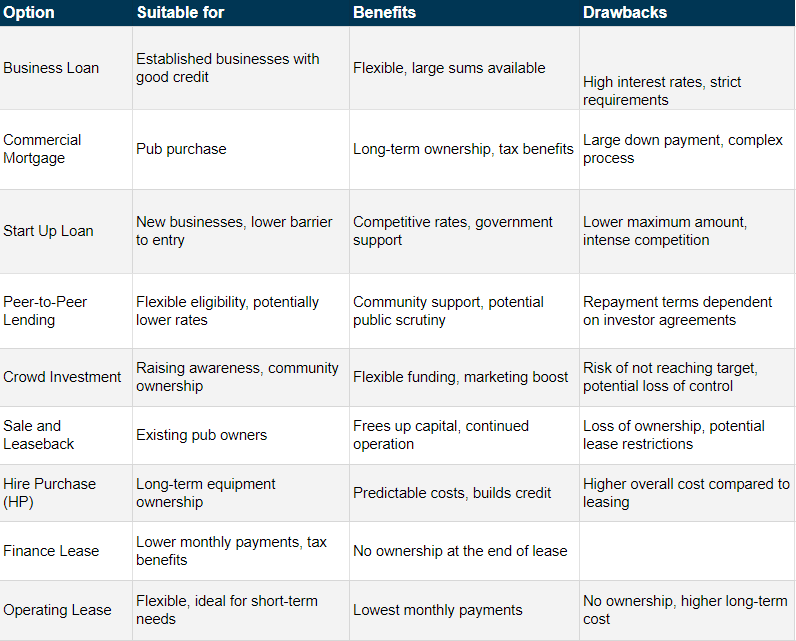

Opening or upgrading a pub involves various costs, from securing a suitable location to acquiring equipment, furnishings, and licenses. Financing a pub typically requires a strategic approach, considering the specific needs and challenges of the hospitality industry.

How Does Equipment Financing Work for Pubs?

- Leasing Bar Equipment:Leasing allows pub owners to acquire necessary equipment without a hefty upfront investment. From beer dispensers to refrigeration units, leasing provides flexibility and the ability to upgrade equipment as needed.

- Hire Purchase for Kitchen Appliances:For pubs with a kitchen, hire purchase agreements can be utilised for acquiring kitchen appliances such as ovens, grills, and refrigerators. This option combines ownership with manageable payment structures.

- Asset Finance for Furniture and Decor:Asset finance can be applied to non-essential but important aspects like furniture and decor. This involves using the assets as collateral for a loan, allowing pub owners to spread the costs over time.

- Government Grants for Sustainable Practices:The UK government encourages sustainable practices in the hospitality sector. Pubs that prioritise eco-friendly equipment may be eligible for grants or incentives, reducing the financial burden of adopting green technologies.

Leasing allows pub owners to acquire necessary equipment without a hefty upfront investment. From beer dispensers to refrigeration units, leasing provides flexibility and the ability to upgrade equipment as needed.

Pub Financing in the UK

Beyond Money: Keys to success

Securing financing is crucial, but remember, a thriving pub hinges on more than just financial planning:

- Concept and Market Research: Understand your target audience, develop a unique concept, and research local competition.

- Location and Licensing: Choose an accessible location with the appropriate liquor licenses.

- Business Plan and Projections: Create a detailed financial roadmap for your pub’s future.

- Marketing and Branding: Craft a strong brand identity and reach your target audience through effective marketing strategies.

- Operational Excellence: Prioritize excellent customer service, efficient operations, and cost control.

Conclusion:

Pub finance in the UK requires a careful balance between the upfront costs and long-term sustainability. By understanding the various financing options available, pub owners can make informed decisions that align with their business goals. Whether you’re dreaming of a traditional English pub or a modern gastropub, a well-thought-out financing strategy will be the cornerstone of your success in the UK pub industry.

Consultation with finance experts can further enhance decision-making processes, ensuring that the chosen financing option optimally supports your business goals.

Get in touch with Fundur, we have over 300 lenders that are available to choose from. Talk to one of our specialists today.

If you are seeking further information about business loans, Fundur is here to support you in making informed decisions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success. With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.