Introduction

Businesses often possess valuable assets that can be utilised beyond their initial purchase. Asset refinance emerges as a powerful financial tool allowing companies in the UK to unlock the value tied up in existing assets. This process enables them to access capital crucial for growth, expansion, or overcoming financial challenges.

How Does Asset Refinance Work?

Asset refinance in the UK involves using existing business assets, such as machinery, vehicles, or equipment, as collateral to secure a loan or line of credit. Here’s an overview of how this process typically operates:

- Asset Valuation: The lender assesses the value of the asset(s) offered as collateral. This valuation determines the amount of funding that can be accessed.

- Loan Agreement: Upon valuation, a loan agreement is established, outlining the terms, loan amount, repayment schedule, and interest rates.

- Release of Funds: Once the agreement is finalised, the lender provides funds to the business based on the asset’s value.

- Asset Use Continues: Despite using the asset as collateral, the business retains the right to continue using it for operations throughout the loan period.

- Repayment: The business repays the loan in instalments over the agreed upon period. Failure to repay may result in the asset’s repossession by the lender.

Understanding the Assets Eligible for Refinance

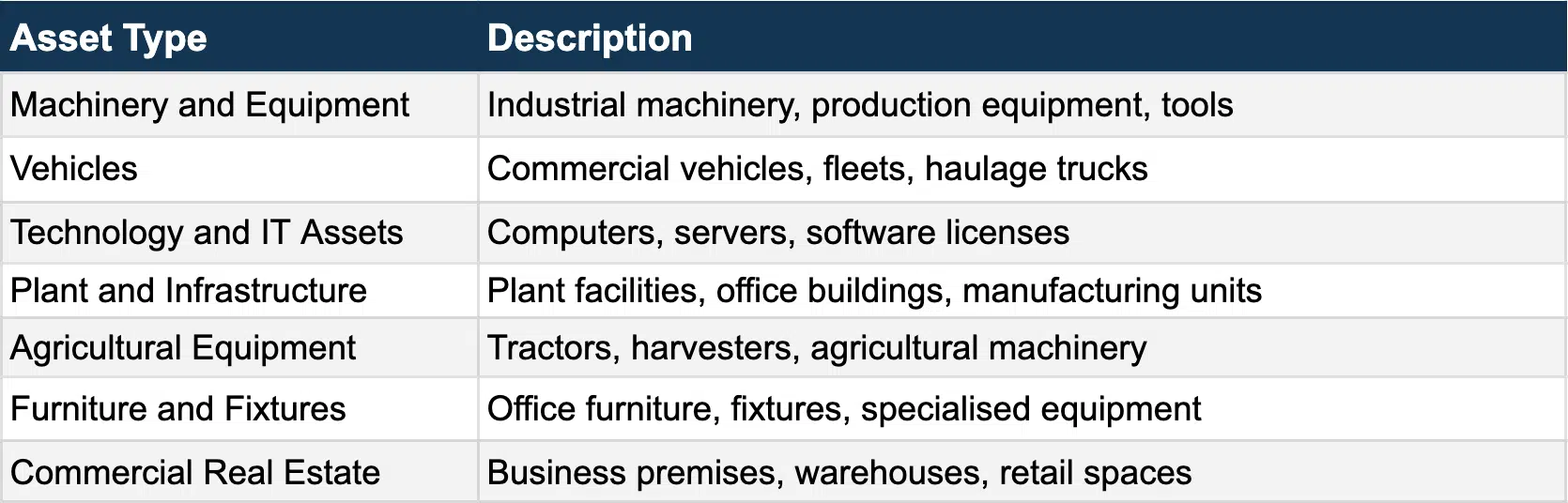

In asset refinance, various business assets can be considered as collateral to secure funding. Here’s a comprehensive table outlining some common types of assets that are often eligible for refinance:

Remember: Consulting a financial advisor before embarking on asset refinance is crucial to ensure it aligns with your business goals and risk tolerance.

Benefits of Asset Refinance in the UK

- Access to Capital: Allows businesses to access immediate capital tied up in existing assets, enabling investment in growth opportunities or resolving financial constraints.

- Preserve Liquidity: Retains cash reserves for operational expenses or emergencies by leveraging existing assets instead of outright selling them.

- Flexible Terms: Offers flexibility in repayment terms, interest rates, and loan amounts, often tailored to the business’s financial situation.

- Business Growth: Facilitates expansion, upgrades, or innovation by injecting capital into the business without the need for traditional borrowing.

Examples of Asset Refinance in Action:

- A construction company refinances their fleet of trucks to invest in new equipment, securing a competitive edge on larger contracts.

- A restaurant refinances their kitchen equipment to upgrade to energy efficient models, reducing operational costs and environmental impact.

- A tech startup refinances its intellectual property to secure funding for product development and expansion into new markets.

Conclusion:

Asset refinance isn’t just a financial tool; it’s a strategic weapon in the arsenal of ambitious businesses. By unlocking the potential within your existing assets, you can fuel growth, seize opportunities, and navigate challenges with renewed confidence. So, step into the arena of asset refinance, unleash the hidden potential of your business, and write a new chapter of success in your entrepreneurial journey.

Consultation with finance experts can further enhance decision-making processes, ensuring that the chosen financing option optimally supports your business goals.

Get in touch with Fundur and talk to one of our specialists today.

If you are seeking further information about business loans, Fundur is here to support you in making informed decisions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success. With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.