Introduction

In a fitness-conscious era, owning a gym in the United Kingdom is a promising venture. However, setting up or upgrading a fitness facility requires significant investment in high-quality equipment. This blog aims to unravel the intricacies of gym equipment finance in the UK, providing insights into how it works and offering guidance for entrepreneurs looking to build their fitness empire.

Understanding Gym Equipment Finance:

The fitness industry is dynamic, with trends and technologies evolving rapidly. To stay competitive, gym owners need access to the latest and most effective equipment. Gym equipment finance becomes a crucial tool, allowing businesses to acquire state-of-the-art machines without a substantial upfront cost.

How Does Gym Equipment Finance Work?

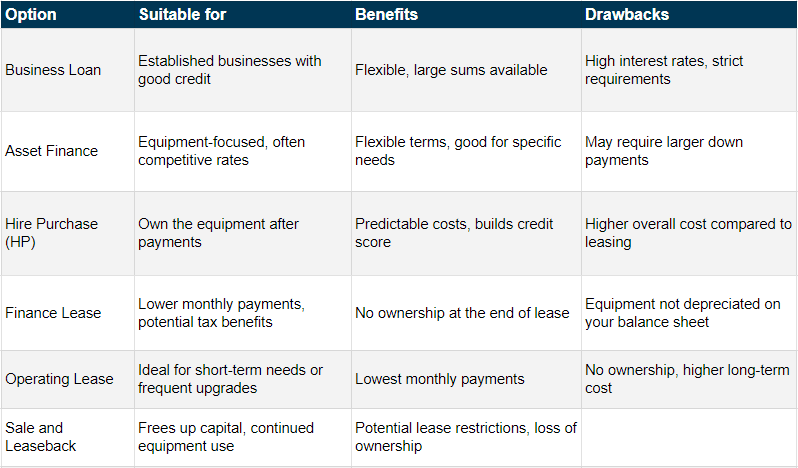

Gym equipment financing involves various financial strategies to help fitness entrepreneurs acquire, upgrade, or maintain the equipment necessary for their gyms. Here’s a breakdown of how gym equipment finance works:

-

- Leasing Fitness Machines:Leasing is a popular option for gym owners looking to minimise upfront costs. With this arrangement, gyms can lease equipment for a set period, paying regular instalments. At the end of the lease term, there is often an option to purchase the equipment at a predetermined residual value.

- Hire Purchase for Cardio and Strength Equipment:Hire purchase agreements are suitable for gyms aiming for eventual ownership. In this model, gyms pay instalments over a fixed period, gaining full ownership of the equipment at the end of the term. This approach combines the benefits of ownership with manageable payment structures.

- Asset Finance for Technologically Advanced Machines:Asset finance involves using the gym equipment itself as collateral for a loan. This strategy is especially useful for acquiring high-tech and expensive machines. It allows gyms to spread the cost over time while retaining ownership from the outset.

- Government Initiatives for Health and Fitness:The UK government encourages a healthier nation, and certain initiatives support gym owners investing in fitness equipment. Gyms may qualify for grants, subsidies, or tax incentives when purchasing approved exercise machines.

Gym Equipment Finance in the UK

Beyond Money: Building a Thriving Gym Community

- Marketing and Branding: Craft a strong brand identity and reach your target audience through effective marketing strategies on both traditional and digital platforms.

- Exceptional Customer Service: Prioritise outstanding customer service, building rapport and loyalty among your members.

- Qualified Staff and Trainers: Invest in qualified staff and trainers who can provide expert guidance and create a welcoming and encouraging atmosphere.

- Community Engagement: Foster a sense of community through events, workshops, and social initiatives, turning your gym into a hub for fitness and well-being.

Conclusion:

Gym equipment finance is the key to unlocking the full potential of a fitness business in the UK. By understanding the diverse financing options available, gym owners can make informed decisions that align with their vision for providing top-notch fitness facilities. Whether you’re establishing a boutique studio or a large fitness centre, a well-structured financing plan will set the foundation for long-term success in the ever-growing UK fitness industry.

Consultation with finance experts can further enhance decision-making processes, ensuring that the chosen financing option optimally supports your business goals.

Get in touch with Fundur, we have over 300 lenders that are available to choose from. Talk to one of our specialists today.

If you are seeking further information about business loans, Fundur is here to support you in making informed decisions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Founder of Fundur

Written by Max Spinelli

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success.

With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.

Max Spinelli, the visionary force propelling Fundur to new heights as your unwavering partner in achieving financial success. With an unyielding commitment to excellence and a proven track record of curating bespoke financial solutions.